Al Rajhi Bank shares traded in negotiated deal

Al Rajhi Bank shares traded in negotiated deal

.gbip::beforecontent:url(https://ssl.gstatic.com/gb/images/silhouette_96.png)@media (min-resolution:1.25dppx),(-o-min-device-pixel-ratio:5/4),(-webkit-min-device-pixel-ratio:1.25),(min-device-pixel-ratio:1.25){.gbii::before{content:url(https://ssl.gstatic.com/gb/images/silhouette_27.png)}.gbip::before{content:url(https://ssl.gstatic.com/gb/images/silhouette_96.png” width=”256px” alt=”акции Al Rajhi Bank”/>|

.gbip::beforecontent:url(https://ssl.gstatic.com/gb/images/silhouette_96.png)@media (min-resolution:1.25dppx),(-o-min-device-pixel-ratio:5/4),(-webkit-min-device-pixel-ratio:1.25),(min-device-pixel-ratio:1.25){.gbii::before{content:url(https://ssl.gstatic.com/gb/images/silhouette_27.png)}.gbip::before{content:url(https://ssl.gstatic.com/gb/images/silhouette_96.png” width=”256px” alt=”акции Al Rajhi Bank”/>| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| }

}

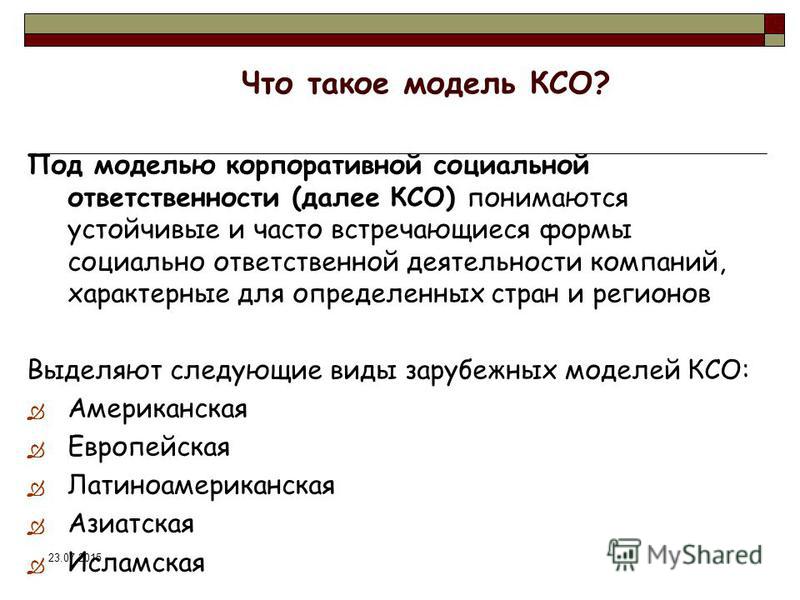

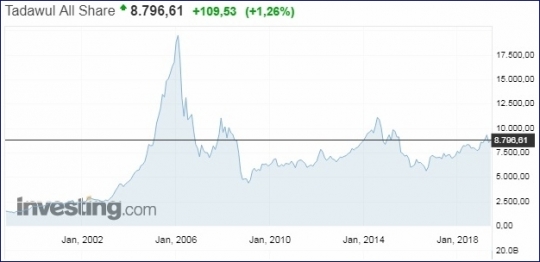

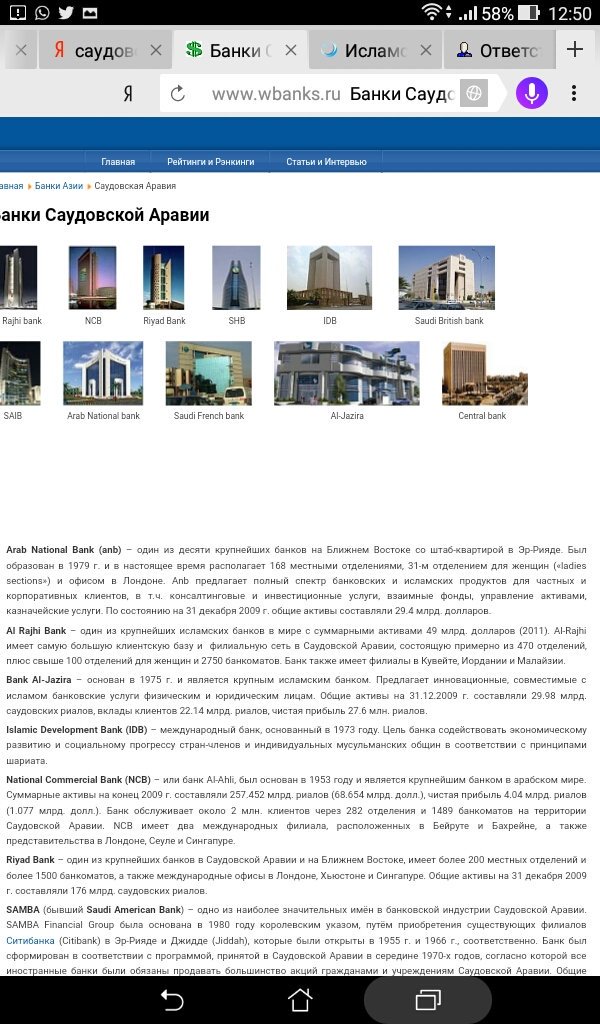

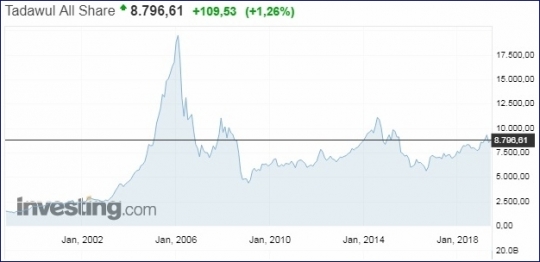

Al Rajhi family members are the bank’s largest shareholders. Al Rajhi Bank, Saudi Arabia’s second-largest lender by assets reported a rise in first quarter (Q1) net profit for 2019, triggering a surge in the bank’s shares on Wednesday. Founded in 1957, Al Rajhi Bank is one of the largest Islamic banks in the world with total assets of SR 343 billion (US$ 90 billion), a paid up capital of SR 16.25 billion (US$ 4.33 billion) and http://www.raadhuislaren.nl/bitcoin an employee base of over 9,600 associates. Sept 4 (Reuters) – Saudi Arabia’s stock market rose sharply on Wednesday, with all its banks gaining amid advancing oil prices on positive news from China’s services sector, while Egypt’s index ended lower as most of its blue-chip stocks dropped. One of the largest Islamic banks in the world and the second biggest lender in Saudi, Al Rajhi is a bellwether for investors in the kingdom.

Image for illustrative purposes. Saudi Arabia is a big country with a fast growing population approaching 30m people, which makes investing in Savola – the country’s largest food group – a good bet.

MIDEAST STOCKS-Saudi stocks slide as funds turn bearish

Here are five companies that the Telegraph believes will provide long-term growth with limited risk to add to any emerging market portfolio. The possibility of combining the balance sheets of Al Rajhi Banking and Investment Corporation Malaysia and Malaysian Industrial Development Finance http://shrouded-castle-6445.herokuapp.com/?p=500 is at an early stage, the Saudi lender said in January. Al Rajhi, Saudi Arabia’s second-largest lender by assets, earlier this year said it is in talks for a merger of its fully-owned subsidiary in Malaysia with a state-backed financial institution in the South-East Asian country.

Get the best best car financing rates… Apply Now

Al Rajhi Bank announces the Board of Directors resolution regarding distribution http://sieuthihanghieu.net/kurs-ajona-k-dollaru-na-segodnja-kurs-ajona-k/ of cash dividends to the shareholders for the first half of 2019.

The bank was started by four brothers, Sulaiman, Saleh, Abdullah, and Mohamed, of the Al Rajhi family, one of the wealthiest families in Saudi Arabia. The bank initially began as a group of banking and commercial operations which, in 1978, joined together under the umbrella of the Al Rajhi Trading and Exchange Company. The company changed to a joint stock company in 1987, and after two years was rebranded as the Al Rajhi Banking and Investment Corporation.

{ |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

||

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

||

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|![]() |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|![]() |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| }

}

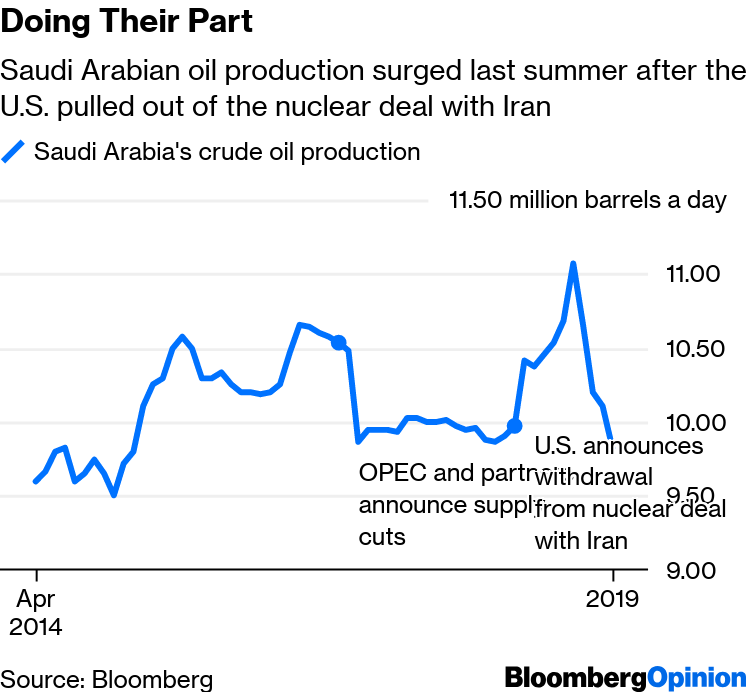

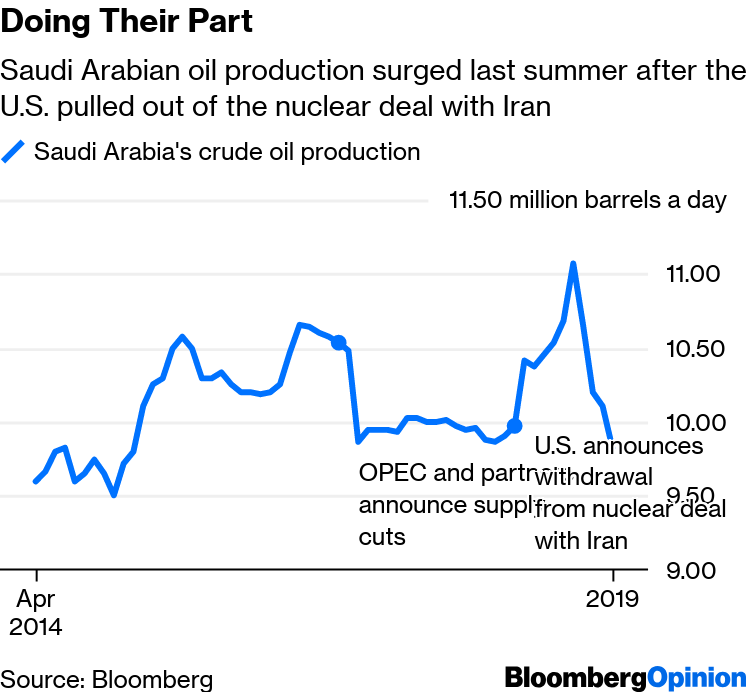

- July 2 (Reuters) – Saudi Arabia’s stock market snapped a five-day winning streak on Tuesday as most banks dropped, while Kuwait rose for a fourth straight session after MSCI announced it would upgrade Kuwaiti equities to its main emerging-markets index.

- Founded in 1957, Al Rajhi Bank is one of the largest Islamic banks in the world with total assets of SR 343 billion (US$ 90 billion), a paid up capital of SR 16.25 billion (US$ 4.33 billion) and an employee base of over 9,600 associates.

- Here are five companies that the Telegraph believes will provide long-term growth with limited risk to add to any emerging market portfolio.

- The company changed to a joint stock company in 1987, and after two years was rebranded as the Al Rajhi Banking and Investment Corporation.

- Image for illustrative purposes.

- Saudi Arabia is a big country with a fast growing population approaching 30m people, which makes investing in Savola – the country’s largest food group – a good bet.

Sixty percent of fund mangers said they would decrease their investments in Saudi Arabia, displaying bearishness that has carried over from last month. Al Rajhi Bank was up 2.7% and National Commercial Bank, the country’s largest lender, surged 4.7%. Lenders National Commercial Bank and Al Rajhi Bank shed 2.7% and 1.2% respectively, while petrochemical maker Saudi Basic Industries lost 2.2%. Yes, all the products and services provided by Al Rajhi Bank are always fully Shari’a compliant. A man walks past a sign of Al Rajhi Capital company in Riyadh, Saudi Arabia, November 8, 2017.

Personal Finance

July 2 (Reuters) – Saudi Arabia’s stock market snapped a five-day winning streak on Tuesday as most banks dropped, while Kuwait rose for a fourth straight session after MSCI announced it would upgrade Kuwaiti equities to its main emerging-markets index. Aug 4 (Reuters) – Saudi Arabian equities declined on Sunday, weighed down by banking shares, in line with major markets on Friday after the U.S. Federal Reserve cut interest rates, which was followed by rate cuts by most Gulf central banks.

Al Rajhi Bank was founded in 1957, and is one of the largest banks in Saudi Arabia, with over 9,600 employees and $88 billion in assets. The bank is headquartered in Riyadh, and has over 600 branches, primarily in Saudi Arabia, but also in Kuwait, and Jordan, with a subsidiary in Malaysia.

However, it was recently forced to replace its chief executive after several quarters of declining profits. Expect a turnaround.

Although bound by desert, Saudi Arabia produces large volumes of its own food, especially milk and processed products such as cooking oils. Samba Financial Group is one of the kingdom’s largest banks and, importantly, is the most profitable. The group posted a 22.5pc rise in its fourth-quarter net profit earlier in January, while its total loans grew by 9.4pc in 2014. The profitability of Saudi banks has been boosted over the last few years by strong lending growth, which sets them apart from many of their global peers in terms of potential yield for investors. Saudi Arabia has opened its stock market to foreigners for the first time but what stocks should investors buy for exposure to the world’s largest oil exporting country?

In 2006, the bank rebranded itself as Al Rajhi Bank. It is traded on the Saudi Arabian Stock Exchange (Tadawul), and around 75% of their shares are publicly owned.

{ |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

||

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

||

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|![]() |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|![]() |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| }

}